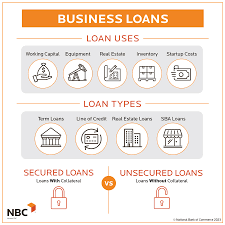

Starting or growing a business requires a lot of capital, and not all entrepreneurs have the financial resources to do so. This is where business loans come in handy. In this article, we will discuss how business loans work, the different types of loans available, and how to determine the best loan for your business.

What are Business Loans?

Business how do small business loans work are financial products that provide funding to businesses for various purposes, such as starting or expanding a business, purchasing equipment or inventory, or covering operational costs. These loans are usually provided by banks, credit unions, or alternative lenders.

Types of Business Loans

There are several types of business loans, each with its own terms and conditions. Understanding the differences between the various loan types can help you determine which one is best suited for your business needs.

1. Term Loans

Term loans are the most common type of business loan. They provide a lump sum of money upfront, which is repaid over a fixed period of time with interest. These loans can have a repayment term of up to 10 years and typically require collateral.

2. Lines of Credit

A line of credit is a flexible form of financing that allows businesses to borrow money up to a certain limit. Interest is only charged on the amount borrowed, and the credit line can be used multiple times as long as the business stays within the limit. This type of loan is useful for covering short-term expenses, such as payroll or inventory.

3. SBA Loans

The Small Business Administration (SBA) provides loans to small businesses that cannot obtain financing from traditional lenders. These loans have lower interest rates and longer repayment terms than conventional loans, making them an attractive option for small businesses. However, the application process can be lengthy and requires a lot of paperwork.

4. Equipment Loans

Equipment loans are used to purchase or lease equipment for business use. The equipment serves as collateral for the loan, making it easier to obtain financing. These loans typically have fixed interest rates and repayment terms of up to 10 years.

5. Invoice Financing

Invoice financing is a type of loan that allows businesses to borrow against their outstanding invoices. The lender advances a percentage of the outstanding amount and collects the payment from the customer when the invoice is due. This type of loan is useful for businesses that have long payment cycles.

How to Get a Business Loan

Getting a business loan requires a lot of preparation and research. Here are the steps you can take to increase your chances of obtaining financing:

1. Determine your business needs

Before applying for a loan, you should determine how much money you need and what you will use it for. This will help you determine which loan type is best suited for your needs.

2. Check your credit score

Your credit score plays a crucial role in obtaining a loan. Make sure to check your credit score and fix any errors before applying for a loan.

3. Gather all necessary documents

Lenders will require a lot of documentation, such as financial statements, tax returns, and business plans. Make sure to gather all necessary documents before applying for a loan.

4. Shop around for lenders

Don’t settle for the first lender you find. Shop around and compare rates and terms to find the best loan for your business.

Conclusion

Business loans are a useful tool for entrepreneurs looking to start or grow their businesses. Understanding the different types of loans available and the application process can help you make informed decisions and increase your chances of obtaining financing.

FAQs

- What is the interest rate on a business loan?

The interest rate on a business loan varies depending on the lender and the type of loan.